The costing of apparel products is one of the most important planning functions performed within the company. Mastery of pricing and costing is crucial for an apparel manufacturer in today’s fast-paced, global marketplace. Costing must be made in such a way that none of the manufacturing, distribution, management process is left out of the calculation. Also, one needs to keep in mind that the profit that has to be made on that. The main objectives of an ideal garment costing and pricing strategies should always be to minimize the wholesale price which in turn will maximize its difference between the retail selling price.

The cost of a garment should be calculated such that it is as accurate as possible to the actual production cost. Thus a competitive market price can be established for that garment. This becomes the responsibility of both a merchandiser and the accountant.

The merchandiser will be responsible for the production costs. And the accountant will be responsible for the overhead expenses. Together will allow for making effective costing and pricing decisions. A merchandiser must be aware of each and every cost from production to financing as he will be responsible for all the pricing decisions.

Related: Garment costing sheet

Below is an example of an effective direct costing method to price a new product being added to a basic shirt line.

The difficulty in this strategy comes in creating a standard costing system which will be able to capture and allocate costs to specific products. It also becomes important to correlate the difference between the activity cost to the actual utilization of that cost by a particular garment style or category to achieve accurate costing results.

Activity-based costing thus focuses on the activity as a base for allocating costs. It becomes the responsibility of the department managers to use these activities with maximum efficiency to justify their expenditures directly for the benefit of product styles or categories.

Below example shows the effect of activity-based costing on the same above example. By this process, the basic shirt is not carrying the overhead burden or additional general and administrative costs generated by the T-shirt. The shirt is also benefited from the fact that some of the fixed costs that it was totally absorbed are now being partially absorbed by the new T-shirt.

Apart from the above, there can be many specialized strategies or variations of the above for product costing depending upon the type of business but the intent of each one of them is to take in consideration each and every expense into the costing as accurately as possible.

Article References:

The cost of a garment should be calculated such that it is as accurate as possible to the actual production cost. Thus a competitive market price can be established for that garment. This becomes the responsibility of both a merchandiser and the accountant.

The merchandiser will be responsible for the production costs. And the accountant will be responsible for the overhead expenses. Together will allow for making effective costing and pricing decisions. A merchandiser must be aware of each and every cost from production to financing as he will be responsible for all the pricing decisions.

Related: Garment costing sheet

Garment Costing and Pricing Strategies

Below are the three cost accounting strategies for identification, measurement, and allocation of costs.- Direct Costing

- Absorption Costing

- Activity Based Costing

1. Direct Costing

This is the most primitive costing strategies used in the apparel industries, sometimes also referred to as variable costing. This method of costing compiles all the variable costs related to materials and labor as product cost or cost of goods. Apart from this the entire non-variable factory expenses, marketing, product development, general and administrative costs are allocated through gross margin as either a fixed cost per garment or as a target gross margin percentage. This form of costing strategy is very effective for companies manufacturing basic garments like basic T-shirt, jeans, khakis, classic suits, etc. with very little variations in labor, product development, and marketing costs.Below is an example of an effective direct costing method to price a new product being added to a basic shirt line.

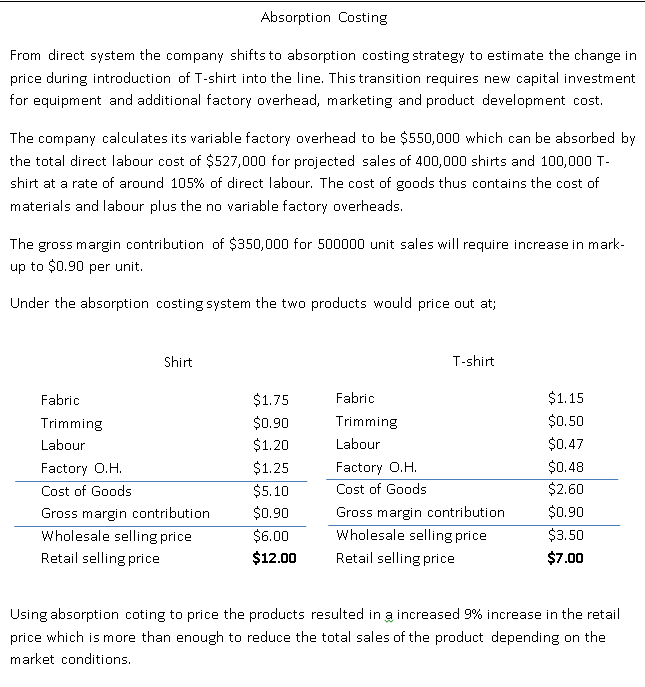

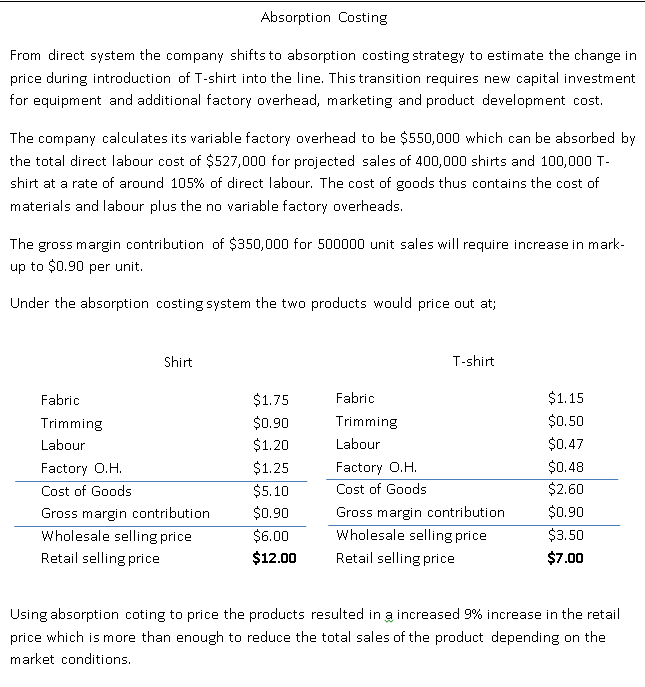

2. Absorption costing

Absorption costing allocates fixed manufacturing overheads to each unit of production along with variable manufacturing costs. It is also referred to as whole cost method. As the name indicates, this method of costing absorbs all the fixed and variable manufacturing costs into the cost of goods, which is used to establish the costing values.

The specialty of this type of costing is that it takes into account the relative effect of variable and fixed manufacturing overheads to each style produced. The advantage of this is that there are more equitable cost distributions of manufacturing overheads between different styles thus low direct labor product does not have to take the burden of high direct labor product’s overhead costs.

The below example shows the effect of absorption costing on the new product being added to a basic shirt line in which the variable manufacturing overheads are applied to each product as a percentage of the direct labor. Whereas the gross margin contribution includes general and administrative costs added as per unit basis.

The below example shows the effect of absorption costing on the new product being added to a basic shirt line in which the variable manufacturing overheads are applied to each product as a percentage of the direct labor. Whereas the gross margin contribution includes general and administrative costs added as per unit basis.

3. Activity-based costing

It is considered the most difficult costing system as well as the accurate. It works on the principle that each activity that generates costs is sorted and calculated separately. The sorted activities are assigned to garments based upon their use of those activities. The examples of these activities are supervision, material management, engineering, operator training, production planning, quality assurance, advertising, market research, etc.The difficulty in this strategy comes in creating a standard costing system which will be able to capture and allocate costs to specific products. It also becomes important to correlate the difference between the activity cost to the actual utilization of that cost by a particular garment style or category to achieve accurate costing results.

Activity-based costing thus focuses on the activity as a base for allocating costs. It becomes the responsibility of the department managers to use these activities with maximum efficiency to justify their expenditures directly for the benefit of product styles or categories.

Below example shows the effect of activity-based costing on the same above example. By this process, the basic shirt is not carrying the overhead burden or additional general and administrative costs generated by the T-shirt. The shirt is also benefited from the fact that some of the fixed costs that it was totally absorbed are now being partially absorbed by the new T-shirt.

Apart from the above, there can be many specialized strategies or variations of the above for product costing depending upon the type of business but the intent of each one of them is to take in consideration each and every expense into the costing as accurately as possible.

Article References: