Author: Dr. Charm Rammandala

Are apparel orders shrinking?

In recent months, many apparel manufacturers from Asia, complaining about the reduction in apparel orders. Due to the order shortage, many manufacturers found their order bookings running low. Unfortunately, it forced manufacturers to reduce the working hours, in some cases, reduce the pay rates and worst-case scenarios, worker reduction.

It was also reported that many manufacturing companies which had multiple production units were, forced to close some of them. The worst hit sector is the subcontract factories who were depending on large manufacturers to place orders with them. Since there is a shortage of orders, large manufacturers first fill their own capacity, before looking for sub-plants. Essentially this means many small & medium-scale manufacturers are without work hence all employees find themselves in a very vulnerable position.

The global apparel market is still 3% behind the pre pandemic levels. This is mainly due to the slow recovery of UK, Europe, and the Latin American countries. Most of the countries in Europe including UK is battling with inflation and effects of the Ukraine/ Russian war. High energy prices and inflation have a significant constraint on the disposable income of the people.

Why?

Let’s look at the statistics to see what’s happening in the apparel industry over the past years.The global apparel market is still 3% behind the pre pandemic levels. This is mainly due to the slow recovery of UK, Europe, and the Latin American countries. Most of the countries in Europe including UK is battling with inflation and effects of the Ukraine/ Russian war. High energy prices and inflation have a significant constraint on the disposable income of the people.

A case study of the US apparel market

If we look at the United States apparel and textile imports in 2022, it was 2.5% less than the pre-pandemic levels. Except for Bangladesh which actually show 36% of the increase, most leading apparel suppliers for the US market saw their export value in 2022 short of or only increased marginally compared with the pre-Covid level, including China (down 21.3%), Association of Southeast Asian Nations (ASEAN) members (up 3.8%), India (up 3.4%), Indonesia (down 5.7%), US-Mexico-Canada Trade Agreement (USMCA) members (down 11.0%), and Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) members (up 0.6%).The reasons for the overall downfall are varied. The obvious and the most impactful reason is the Covid-19 pandemic. It disrupted the way of life of all most all the people. The impact is multifaced. Firstly, it completely changed our mindset of how we work. Working from home was a disaster for apparel industry. While its true, there was a significant improvement in sales of loungewear and leisurewear, all most all other categories suffered and continue to suffer. Same goes for the young adults too. During the pandemic schools were closed hence sales of uniforms and other clothes were down (In US many public schools don’t have a uniform and students wear whatever they feel comfortable).

Since then, the market recovered but most of the community colleges and universities continue to offer online classes. Students have the option of taking onsite classes, online classes, or hybrid. This means overall market has shrunk. Not having to go to physical classes means less demand for clothing.

Disruptions in supply chain and logistics also having a significant strain on the apparel industry. The cost of manufacturing and shipping have gone up, compared to pre pandemic rates. This is causing price hike for the consumers who are already facing strains on their budgets.

As an offshoot of this phenomena, there is a significant growth visible in the pre-owned clothing market also knows as secondhand clothing market. the global second-hand and resale market was worth $96 billion in 2021. That number is expected to rise to $218 billion by 2026. Notable percentage of generation Y (Millennials) born from 1980 to 1994 & generation Z from 1995 to 2009 are highly concerned about the global warming hence opt out buying new clothing when possible while it appears generation Alpha (2010 to 2024) would rather spend money on computer games and new technology.

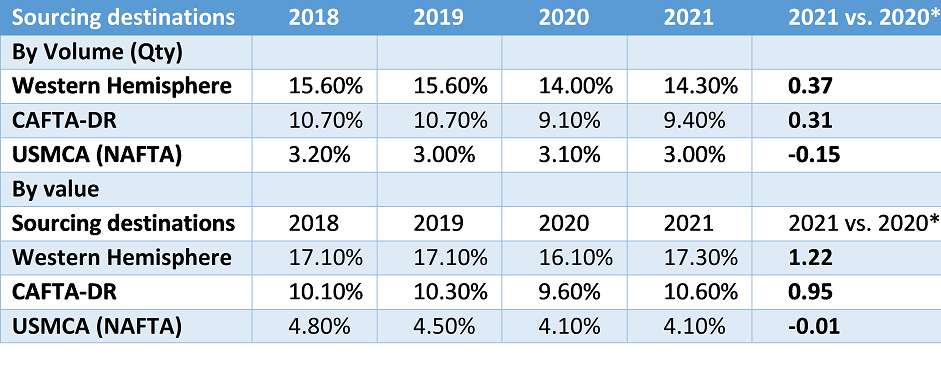

As US fashion companies diversify their sourcing from Asia, near-sourcing from the Western Hemisphere, particularly members of USMCA and CAFTA-DR, benefit. US apparel companies placed relatively more sourcing orders with suppliers in the Western Hemisphere in 2022. For example, CAFTA-DR members’ market shares increased by a 0.31 percentage points in quantity and nearly one percentage point in value compared with a year ago. Though numbers are marginal, the trend is upward.

Percentage of US Apparel Imports from the Western Hemisphere

Since then, the market recovered but most of the community colleges and universities continue to offer online classes. Students have the option of taking onsite classes, online classes, or hybrid. This means overall market has shrunk. Not having to go to physical classes means less demand for clothing.

Disruptions in supply chain and logistics also having a significant strain on the apparel industry. The cost of manufacturing and shipping have gone up, compared to pre pandemic rates. This is causing price hike for the consumers who are already facing strains on their budgets.

The impact of global warming

Today’s consumers are much better informed and educated about the geo-politics and current issues. Global warming is in the forefront of their concerns and eager to be part of the solution instead of the problem. Consumers are much more likely to contemplate on the environmental impact of their purchasing and avoid unnecessary buying. This is having a considerable impact on the overall clothing sales.As an offshoot of this phenomena, there is a significant growth visible in the pre-owned clothing market also knows as secondhand clothing market. the global second-hand and resale market was worth $96 billion in 2021. That number is expected to rise to $218 billion by 2026. Notable percentage of generation Y (Millennials) born from 1980 to 1994 & generation Z from 1995 to 2009 are highly concerned about the global warming hence opt out buying new clothing when possible while it appears generation Alpha (2010 to 2024) would rather spend money on computer games and new technology.

Why are Asian apparel manufacturers impacted?

Due to the learnings of Covid-19, US government as well as the buyers, understood the importance of having manufacturing closer to home. The government is actively encouraging companies to source from within the country or closer to home. Also, with the increased awareness of the customers, companies are forced to cut down their carbon footprint hence need to find closer destinations for manufacturing needs. Evidently, near-sourcing from the Western hemisphere is growing in popularity.As US fashion companies diversify their sourcing from Asia, near-sourcing from the Western Hemisphere, particularly members of USMCA and CAFTA-DR, benefit. US apparel companies placed relatively more sourcing orders with suppliers in the Western Hemisphere in 2022. For example, CAFTA-DR members’ market shares increased by a 0.31 percentage points in quantity and nearly one percentage point in value compared with a year ago. Though numbers are marginal, the trend is upward.

Percentage of US Apparel Imports from the Western Hemisphere

Data source: OTEXA (2022) *: Percentage point

It’s similarly important to realize the effects of contemporary geopolitics and its impact to the industry. It is well-known that the US actively discourages Chines imports to US. To counter this, Chinese apparel manufacturers made a strategic move to establish manufacturing plants in newly emerging destinations such as Vietnam, Cambodia, and other neighboring countries as well as Sri Lanka and Pakistan. Though initially, this was a winning move, now it appears that buyers have caught up and bypassing those companies. It is making a dent on the overall export values of each country.

The financial crisis in Sri Lanka and Pakistan is largely responsible for those countries struggle to find apparel buyers. Lack of US dollars hindering the import of raw materials and paying for logistics. Further, high energy prices and inflation has increased overall manufacturing cost making their FOB prices non-competitive.

It’s similarly important to realize the effects of contemporary geopolitics and its impact to the industry. It is well-known that the US actively discourages Chines imports to US. To counter this, Chinese apparel manufacturers made a strategic move to establish manufacturing plants in newly emerging destinations such as Vietnam, Cambodia, and other neighboring countries as well as Sri Lanka and Pakistan. Though initially, this was a winning move, now it appears that buyers have caught up and bypassing those companies. It is making a dent on the overall export values of each country.

The financial crisis in Sri Lanka and Pakistan is largely responsible for those countries struggle to find apparel buyers. Lack of US dollars hindering the import of raw materials and paying for logistics. Further, high energy prices and inflation has increased overall manufacturing cost making their FOB prices non-competitive.

So, what are the solutions?

Well, it’s not all bad. The United States apparel imports are showing signs of recovering fast. Though we discussed overall imports are lagging by almost 2.5% pre-pandemic levels, when comparing year-on-year apparel import figures, we could see the industry is recovering. Apparel imports to the US increased by almost 30%, a significant growth after the pandemic.The growth rate of US apparel imports (by value)

As a manufacturer, it is important to understand the changing market dynamics and customer expectations. It is time to realign the company values, strategies, and overall growth expectations. Some of the strategies to overcome the current market dip include, focusing on green manufacturing and green products. These initiatives shouldn’t be just limited to getting a certification or erecting a large advertising board claiming the factory is green. Buyers and consumers are much more sophisticated, and they understand who’s doing a lip service and who’s genuinely cares about the green cause.

It is important to ensure overall manufacturing operation is geared towards reducing carbon emissions rather than just having bits and pieces here and there. There should be a compelling story to tell. Further, integrating green product lines to your product offerings would make it attractive to buyers and customers. New developments made of recycled products and carbon-neutral production facilities would help to get you over line.

Most of the apparel manufacturers in Asia prefer orders which are large in quantities and always running the same or similar products. This mindset needs to change. Most apparel buyers now realizing the cost of inventories. They prefer maintaining minimum inventories and replacing when needed. Most future orders will be less in quantity with potential repeat orders based on sales volumes and customer preference. It is important to be flexible and accommodate multiple product categories while offering short lead times.

Focusing on non-traditional markets is also a great way to ensure continuous orders. Most manufacturers prefer to work with big brand buyers yet there is a huge potential to tap into boutique stores. Boutique stores buy smaller quantities but if consolidated orders among a few stores, large enough orders could be created. There are over 160,000 boutique clothing stores in the United States as of January 2023. It is obvious how much of a significant market waiting to be catered to.

Another potential market is event management. Many multinational companies, organizations, and institutes have multiple events throughout the year where they need many types of clothing items. Some conferences are as big as 50,000 participants. Having a team of merchandisers and marketers looking into these market segments would help to feed a few production lines continuously.

Related article: A Close Examination of the Sri Lankan Apparel Industry